Blog Articles

Does the Federal Reserve Affect Mortgage Rates? 7 Factors That Influence Your Rate

Posted on

By understanding and managing key factors such as your credit score, down payment, property type, and loan amount, you can position yourself to secure the best possible rate for your home purchase.

Read MoreRenovate Smarter, Not Harder: Quorum’s Renovation HELOC

Posted on

By leveraging your home’s future value and avoiding the need for refinancing or PMI, you can embark on your renovation projects with confidence

Read MoreHouse Rich, Cash Poor? Here’s How to Buy Your Next Home Without Selling First

Posted on

It’s possible to sell your old home and buy a new one without facing qualification or timing challenges, and it’s important to become familiar with the differences between each alternative

Read MoreUnderstanding Home Equity: A Valuable Asset for Homeowners

Posted on

Home equity is more than just a number on a balance sheet; it’s a valuable asset that can be used to improve your financial well-being. Whether you’re looking to make home improvements, consolidate debt, or cover large expenses, tapping into your home equity can help you achieve your goals.

Read MoreContingent vs. Pending Properties: What’s the Difference?

Posted on

If you’re eyeing a contingent or pending property, you may still have opportunities to make an offer or view the home. Understanding these distinctions can empower you to act swiftly and strategically in a competitive market.

Read MoreHow a Reverse Mortgage Can Help Fund Healthcare and Home Renovation Needs

Posted on

And with over 11,000 people turning 65 each day, the demand for innovative retirement solutions is greater than ever. We strive to enhance your financial options during retirement, providing you with the resources to navigate your golden years with confidence.

Read MoreHighly Anticipated FHA 203(k) Loan Updates Coming Soon

Posted on

With higher allowable renovation amounts and extended timelines, the 203k loan program is becoming increasingly flexible and attractive for homebuyers looking to invest in fixer-uppers.

Read MoreEverything You Need to Know About Closing Costs

Posted on

Buying a home is an exciting journey, but over 50% of first-time homebuyers are caught off guard by closing

Read MoreA Homeowner’s Guide to Using an Escrow Account for Your Property Taxes

Posted on

Property tax escrow accounts are a significant component of homeownership, providing a structured way to manage your property tax payments. By understanding how these accounts work, you can navigate your mortgage with greater confidence and ease.

Read MoreRental Costs Are on the Rise: Why Owning a Home Is More Attractive Than Ever

Posted on

In the face of rising rental costs, the shift towards homeownership is more pertinent than ever. By taking advantage of down payment assistance programs and understanding the true benefits of owning, you can start paving the way toward a more secure financial future.

Read More10 Home Maintenance Projects to Complete This Fall

Posted on

Taking a proactive approach to home maintenance not only enhances your comfort but also helps prevent costly repairs in the future.

Read MoreWhy Banks Use Escrow Accounts for Homeowner’s Insurance and How It Benefits You

Posted on

Navigating homeowner’s insurance and escrow accounts can seem complex, but understanding these components will help you manage your finances effectively.

Read More203(k) Loans: Your Solution for Renovation and Appraisal Challenges

Posted on

Whether you’re facing renovation funding challenges or dealing with appraisal issues, a 203(k) loan may provide a flexible solution to help you achieve your home improvement goals.

Read MoreNumber of Homes for Sale Increases by 19.8%: How to Navigate the Recent Surge in Inventory

Posted on

The housing market is experiencing a notable shift as inventory levels increased by 19.8% year-over-year.

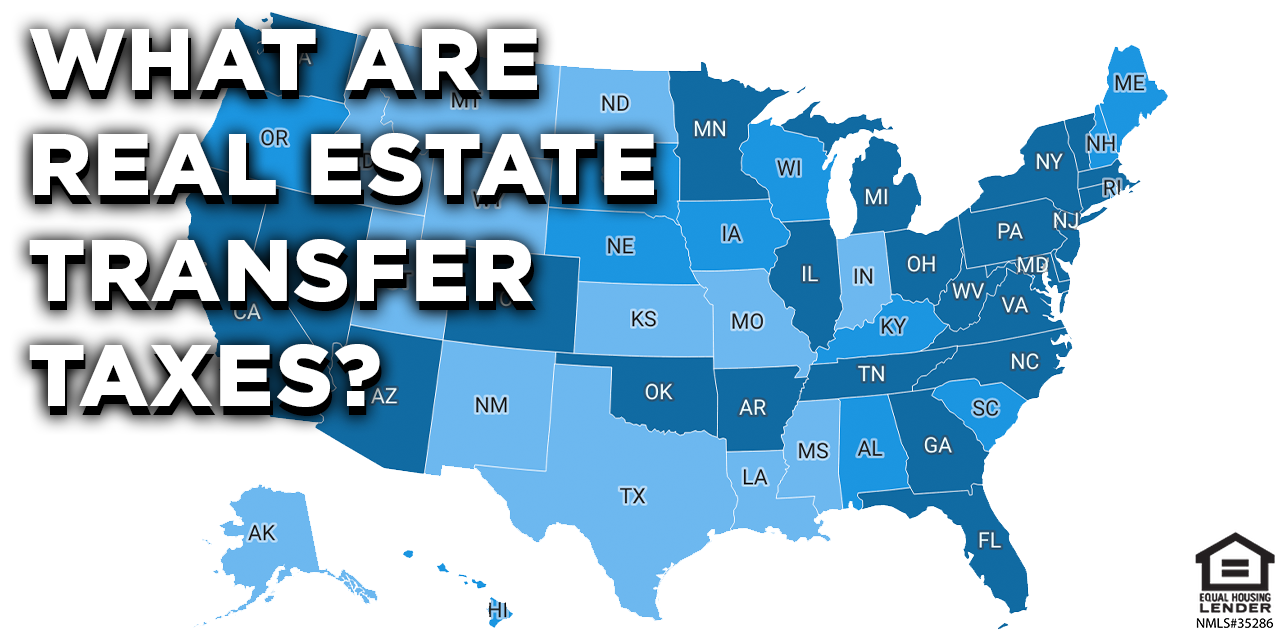

Read MoreReal Estate Transfer Taxes: What to Consider When Selling Your Home

Posted on

When it comes to selling a home, many homeowners are not aware of their state’s transfer tax,

Read More